does wyoming charge sales tax

Although Wyoming charges 4 of sales tax a few items are exempt from the sales tax in Wyoming. Wyoming has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state.

Usa California Pg E Pacific Gas And Electric Company Utility Bill Template In Word And Pdf Format Version 2 Bill Template Templates Words

You can lookup Wyoming city and county sales tax rates here.

. Tax rate charts are only updated as changes in rates occur. For anything but a sole proprietorship you will most assuredly need one. The state sales tax rate in Wyoming is 4.

With local taxes the total sales tax rate is between 4000 and 6000. Wyoming Sales Tax Rate. Does Wyoming have sales and use tax.

Sales taxes in Wyoming are calculated at checkout on the APMEX website based on 1 the taxability of products sold by APMEX in Wyoming set forth above and 2 the specific tax rates established by the taxing jurisdiction of the delivery address in Wyoming. The maximum local tax rate allowed by Wyoming law is 2. But the measure wasnt created.

While Wyomings sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Sales tax 101 Wyoming first adopted a general state sales tax in 1935 and since. The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

The state of Wyoming has a 4 state sales tax for all purchases of goods and services in Wyoming. State wide sales tax is 4. While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation.

In addition to taxes car purchases in Wyoming may be subject to other fees like registration title and. Municipal governments in Wyoming can additionally levy a local-option sales tax which can range from 0 to 2 across the state with an average local tax of 1472 percent for a total of 5472 percent when combined with the state sales tax. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming.

Some LLCs pay Wyoming sales tax on products. In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5. You have to pay for these items in grocery food.

Select the Wyoming city from the list of popular cities below to see its current sales tax rate. This page discusses various sales tax exemptions in Wyoming. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

Sales Use Tax Rate Charts. Charge the tax rate of the buyers address as thats the destination of your product or service. APMEX began collecting sales taxes in Wyoming in February 2019.

As a business owner selling taxable goods or services you act as an agent of the state of Wyoming by collecting tax from purchasers. In addition to taxes car purchases in Wyoming may be. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. The state-wide sales tax in Wyoming is 4. There are additional levels of sales tax at local jurisdictions too.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. To learn more see a full list of taxable and tax-exempt items in Wyoming. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect.

The wholesaler shall be entitled to retain four percent 4 of any tax collected under WS. According to House Bill 169 raising the state sales and use tax rate from 4 to 5 could generate between 138 and 142 million for the state annually and approximately 63 million for localities. There are currently nine states without income tax.

Wyoming has no state income tax. It is also the same if you will use Amazon FBA there. Wyoming charges 60 to register a new business sales tax permit but nothing to renew an existing one.

At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2. Wyoming WY Sales Tax Rates by City The state sales tax rate in Wyoming is 4000. In addition many counties assess an optional 5th penny or 5 general purpose tax which is also incurred on goods and services purchased in that county.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. This page describes the taxability of services in Wyoming including janitorial services and transportation services. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935.

Have a question or comment. Similar to income taxes payroll. Do I need a Federal Tax ID Number or EIN to register for a Wyoming sales tax permit.

Sales Tax Exemptions in Wyoming In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Wyoming law allows for a maximum local tax rate of 2 percent. Wyoming has recent rate changes Thu Apr 01 2021.

Machinery raw materials utilities fuel medical goods services newspapers general maintenance contracts custom software and lastly general trade links. An example of taxed services would be one which sells repairs alters or improves tangible physical property. This is the same whether you live in Wyoming or not.

This is not enough yet. Groceries and prescription drugs are exempt from the Wyoming sales tax Counties and cities can charge an additional local sales tax of up to 2 for a. Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale.

Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1472 for a total of 5472 when combined with the state sales tax. A third sales tax you might encounter in Wyoming is an optional 6th penny or 6 special. Unfortunately this only works in reverse with two states.

If I buy cigars from a company in Colorado who is not a wholesaler in Wyoming as a Wyoming vendor am I responsible for the 20 excise tax. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. See the publications section for more information.

U S States With No Sales Tax Taxjar

Twin 3pc Pattened Sheet Set Ebay In 2022 Sheet Sets Bed Sheet Sets Sheet

U S Sales Taxes By State 2020 U S Tax Vatglobal

What Are Wash Trading And Money Laundering In Nfts Waus In 2022 Money Laundering Know Your Customer Tax Refund

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

When Did Your State Adopt Its Sales Tax Tax Foundation

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Coinbase Dashboard Illinois West Virginia South Dakota

Avoid Penalties By Staying Aware Of Sales Tax Laws

Sales Tax By State Is Saas Taxable Taxjar

How To File And Pay Sales Tax In Wyoming Taxvalet

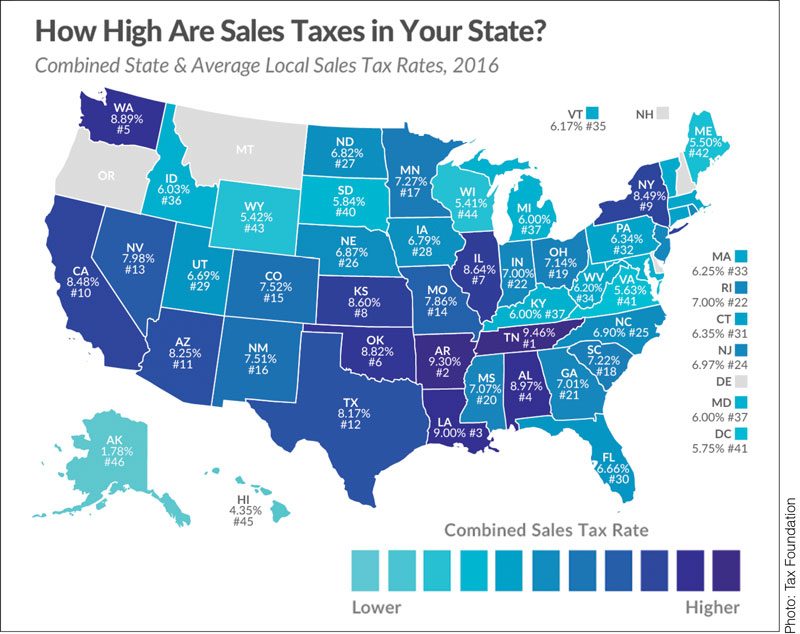

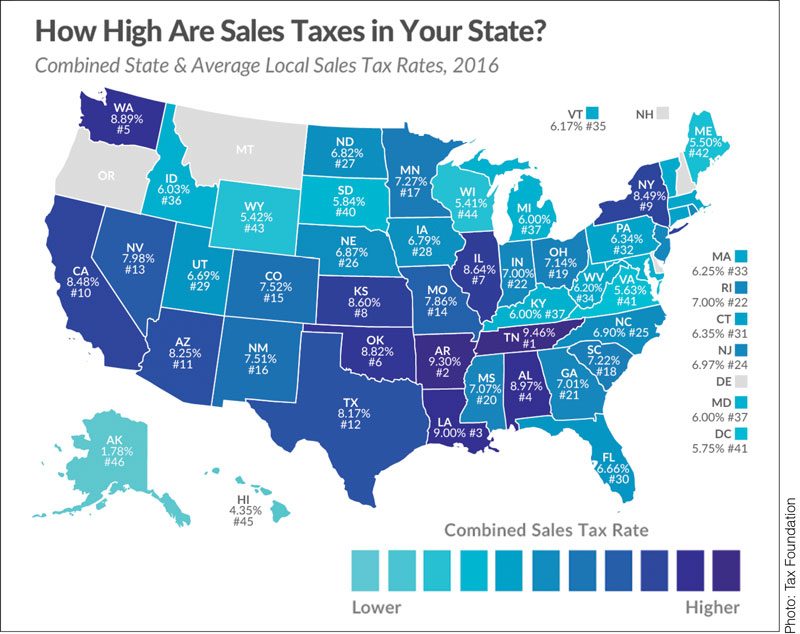

Updated State And Local Option Sales Tax Tax Foundation

How To File And Pay Sales Tax In Wyoming Taxvalet

Wyoming Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation