knoxville tn state sales tax

County Property Tax Rate. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county.

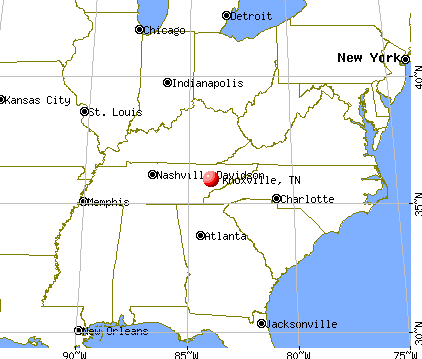

Knoxville Property Tax How Does It Compare To Other Major Cities

Tax Sale 10 Properties PDF.

. Ad Find Out Sales Tax Rates For Free. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. The current total local sales.

Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments.

The Tennessee state sales tax rate is currently. Purchases in excess of 1600 an additional state tax of 275 is added up to a. This bid will NOT include the 2013 2014 or the 2015 taxes due to the City of Knoxville Tennessee or Knox County Tennessee.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Ad New State Sales Tax Registration. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. Hendersonville TN Sales Tax Rate. Thus the sale of each property is made subject to these.

Sales or Use Tax Tenn. The 925 sales tax rate in knoxville consists of 7 tennessee state sales tax and 225 knox county sales tax. Food is taxed at 4 instead of the state rate of 7.

1 State Sales tax is 700. Local collection fee is 1. 4 rows Knoxville TN Sales Tax Rate.

State Sales Tax is 7 of purchase price less total value of trade in. City of Knoxville Revenue Office. Has impacted many state.

Generate supporting reports 3. The 2018 United States Supreme Court decision in South Dakota v. Current Sales Tax Rate.

6 rows The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state. Apply for a Pilot Flying J Accountant II Sales Tax job in Knoxville TN. Local Sales Tax is 225 of the first 1600.

We will contact businesses submitting the application by fax or email at the telephone number you list on the application and you may then provide creditdebit card information for the transaction. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None.

2022 Tennessee state sales tax. This tax is generally applied to the retail sales of any business organization or person engaged. Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes.

State Tax information registration support. The general state tax rate is 7. Sales Tax and Use Tax Rate of Zip Code 37931 is located in Knoxville City Anderson County Tennessee State.

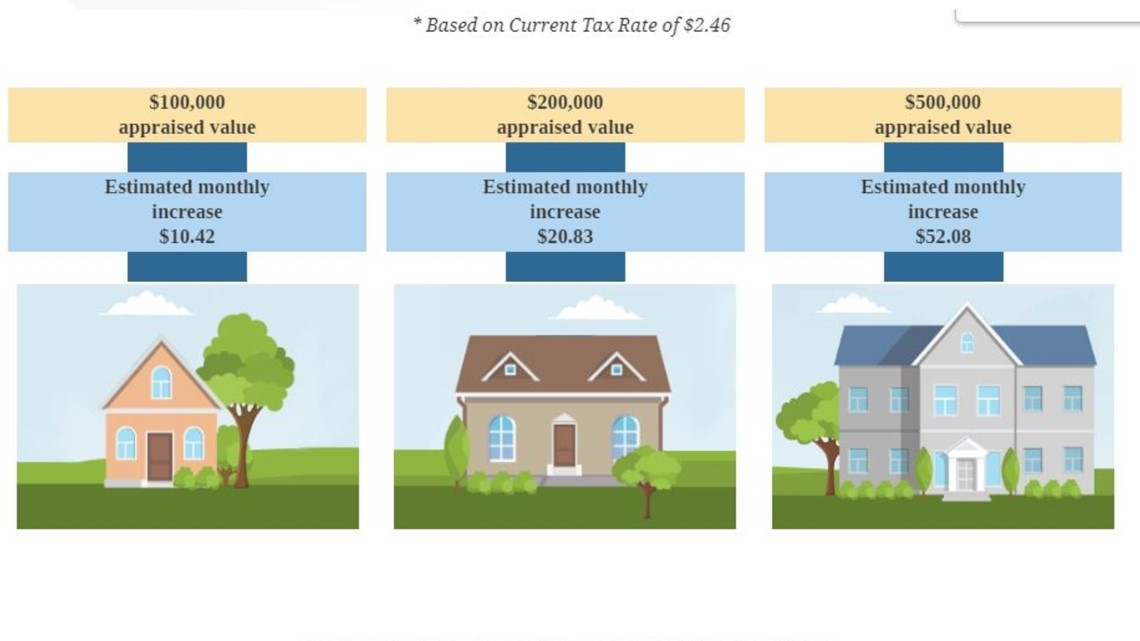

24638 per 100 assessed value. 925 7 state 225 local City Property Tax Rate. File state and local sales tax returns 2.

Fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. This amount is never to exceed 3600. Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County Tennessee State.

The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state. This is the total of state and county sales tax rates. 212 per 100 assessed value.

These exceptions include medical supplies and packaging. 1 State Sales tax is 700. Exact tax amount may vary for different items.

In 2021 Tennessee honored a sales tax holiday three different times throughout the year with more planned for 2022. The sales tax is comprised of two parts a state portion and a local portion. Germantown TN Sales Tax Rate.

Provide internal customer service related to W-9 and exemption. The local tax rate varies by county andor city. 24638 per 100 assessed value county property tax rate.

Fast Easy Tax Solutions. The sales tax holiday in Tennessee has historically meant that any purchase of computers clothing and school. You selected the state of tennessee.

The Knox County sales tax rate is. TN Sales Tax Rate. This table shows the total sales tax rates for all cities and towns in Knox County including all local taxes.

View this and more full-time part-time jobs in Knoxville TN on Snagajob. The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945.

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Ut Football Google Search University Of Tennessee Tennessee Football Tennessee Volunteers Football

Ashley Furniture Signs Displays Knoxville Tn At Home Store Ashley Furniture Sign Display

Tax Consequences When Selling A House You Inherited In Knoxville Capital Gains Tax Sell My House Fast Owe Taxes

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Computer Glitch At Ingles Charging Sales Tax During Tennessee Tax Free Holiday Wcyb

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Tennessee May Implement Property Tax Increases

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Knoxville Mayor Proposes Property Tax Increase In New Budget Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Amp Pinterest In Action Business Plan Template Free Business Plan Template How To Plan

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Knoxville Mayor Proposes Property Tax Increase In New Budget Wbir Com

Accu Tax Of Greater Knoxville Home Facebook

Proof Of Funds Letter 25 Best Proof Of Funds Letter Templates Template Lab By Templatelab Com Figure Out Wh Letter Templates Lettering Business Mentor